Benefits of the CFE Credential

The CFE credential provides private-sector investigators with the knowledge required to conduct investigations of civil or criminal fraud, or of white-collar crime. Earning the CFE credential gives you an understanding of why people commit fraud and ways to prevent it, the types of fraudulent financial transactions, and interviewing, records and transactions. This knowledge set will place you as a leading expert in the fraud investigation field.The ACFE’s 2024 Compensation Guide for Anti-Fraud Professionals found that CFEs earn a 32% income premium over their peers without the credential, which demonstrates the value employers place on the credential. The study also provides valuable information and comparisons helpful to all anti-fraud professionals in benchmarking their compensation levels and career growth. The training, fraud resources and continuing education provided by the Association of Certified Fraud Examiners (ACFE) will help in any stage of your career path. Refer to the Compensation section below for more information about the compensation ranges for private-sector investigators.

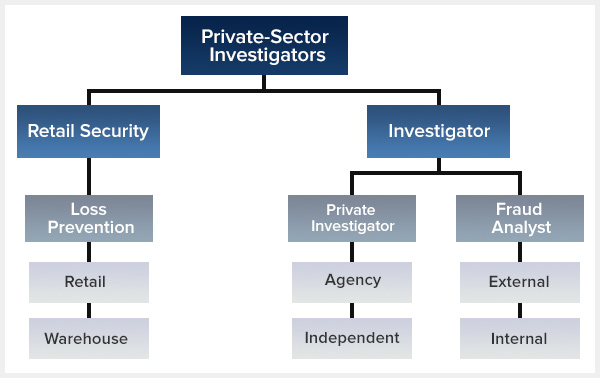

Job Types

Loss Prevention

Most businesses that possess an inventory of goods in a warehouse or retail environment devote significant resources to a Loss Prevention department. Loss prevention professionals are committed to reducing inventory shrinkage and preventing retail larceny by both customers and employees. They are commonly tasked with conducting covert physical and video surveillance, as well as the apprehension of shoplifters. Additionally, they are often involved in the development of security strategies necessary for the protection of a company’s assets and employees.

Private Investigator

Private investigators conduct investigations by gathering evidence through interviews, surveillance and computer research. Types of private investigators include computer forensic, financial, legal, corporate and loss prevention. Most states require a license to become a private investigator and you may be required to obtain a city license in some states.

Internal Fraud Analyst

Most medium-to-large-sized companies employ internal fraud analysts. These analysts are tasked with identifying fraud perpetrated by members of the company’s employee base. Internal fraud analysts routinely take action on employee tips, exception reports, and irregularities found in compliance and sales audits. The internal fraud analyst is responsible for gathering evidence, writing detailed reports and interviewing employees. Internal fraud departments are often responsible for developing best practices and educating employees about fraud awareness.

External Fraud Analyst

Whereas internal fraud analysis is primarily concerned with monitoring a company’s own employees, external fraud analysis deals with outside fraudsters, many of whom conduct schemes in collusion with current or former employees. External fraud commonly occurs with vendors and subcontractors running various billing or sales schemes against a company. External fraud analysts also investigate instances of pretexting and social engineering intended to steal sensitive information. Additionally, external fraud analysts are sometimes involved in examining various forms of cyberfraud, including phishing or hacking attempts.

Education

For most private-sector fraud investigators, a high school education is required. Some college education or a bachelor’s degree in law enforcement or criminal justice is a plus and sometimes required. Private investigators learn most of their skills on the job and may be required to obtain a license. For individuals in loss prevention and internal and external fraud analysis, a bachelor’s degree is usually preferred.Knowledge, Skills and Abilities

It is important to plan and conduct an honest self-assessment of your knowledge, skills and abilities. In particular, employers are looking for:

| Knowledge | Skills | Abilities |

|---|---|---|

|

White-collar crime |

Conduct surveillance | Attention to detail |

| Organized crime | Evidence collection | Functions in stressful situations |

| Financial crime | Conduct interviews | Alert to surroundings |

| Computer forensic | Record examination | Understands associated risks |

| Bribery and corruption | Writing reports | Honest |

| Money laundering | Computer | Sound judgement |

| Loss prevention | High integrity | |

| Counterfeiting | Responsible | |

| Fraudulent documents | Strong judge of character | |

| Credit card fraud |

Compensation

Income level varies depending on education, experience and certifications. Download the 2024 Compensation Guide for Anti-Fraud Professionals, which benchmarks salary and benefits across several categories for Certified Fraud Examiners (CFEs) and other non-certified anti-fraud professionals around the world.